The Final Application will be started from 1st August 2022. Total 45 Lakhs students have been selected for the Final Application.

Sales Tax And Service Tax 2018 Sage 300 Malaysia

You can refer to our video for the journal entries and submission guide.

. View GST final returnxlsx from BUSINESS MISC at Methodist Pilley Institute - Malaysia. By 29 December 2018. Please be informed that pursuant toSection 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within120 days from 01092018.

Please also take note on 28 August 2020 we found out that the due date 31082020 was removed. The deadline for the return is no later than 120 days after 1 September 2018 ie. Submission for GST period for Output and Input Tax with 0 tax rate.

According to the GST guides no GST adjustment is allowed to be made after 31 August 2020. The move of scrapping the 6 GST has paved the way for the re-introduction of SST which will come into effect in 1 September 2018. The deadline for GST filing GST Returns and payment of GST is the last day of the month following the taxable period.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Captain Roseley Enterprise Sdn Bhd Final submission of GST-03 return 5a Sales Stock value Fixed. Deloittes view The Document Guide represents a further shift in the RMCD opinion on interpreting the complex transitional rules contained in the GST.

The existing standard rate for GST effective from 1 April 2015 is 6. You can also refer to RMCDs Tax Invoice Guide and GST Adjustments guides. The submission of this final GST return fell on 28 December 2018.

Please note that payments are due on the same deadline and it can be paid via bank transfer. Goods and Services Tax. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

It is uncertain whether the RMCD will require the submission of an administrative return for taxpayers to declare tax due and payable after the last taxable period. General Science and Technology University GST Admission Primary Application Result for the academic session 2020-21 has been published on 19 July 2022. GST Guide on Tax Invoice Debit Note Credit Note and Retention Payment After 1 September 2018.

Report all supplies made in the last taxable period and pay the GST due and payable relating to those supplies. This is a reminder to businesses that the amendment to the final GST-03 return if any needs to be made by 31 August 2020. Students who are selected in the Preliminary Result can fill up the.

Businesses have to charge and collect GST on all taxable goods and services supplied to the consumers. Final submission to claim Input Tax. Submission of GST 03 GST 04 for final taxable period.

However there is a. Please be informed that all GST registrants are required to submit the GST-03 Return and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from September 1st 2018. Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax imposed.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. The firm in Malaysia has 13. All the above require some adjustments to your accounting and also to amend the Final GST Return.

Filing can be done either by post or online. Businesses are allowed to claim whatever amount of GST paid on the business inputs by offsetting against the output tax. Please be informed that pursuant to Section 7 of Goods and Service Tax Repeal Act 2018 the non-GST Registrants are required to submit the final GSt-04 Return and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 30 days from 01092018 ie.

In cases where GST was accounted for on retention sums received or invoiced after 1 September 2018 a credit note may be issued and an amendment should be made to the final GST Return. Segala maklumat sedia ada adalah untuk rujukan sahaja. Crowe Malaysia PLT is the 5th largest accounting firm in Malaysia and an independent member of Crowe Global.

Malaysia may look at a possible implementation of the Goods and Services Tax GST in the medium term likely by 2022 or 2023 to help correct the governments fiscal position and. That means any GST return is due within 30 days of the end of the reporting period. By or before 30th September 2018.

Only businesses registered under GST can charge and collect GST. Input tax credit mechanism. Sept 2018 - Dec 2018.

Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax. Submission GST-03 Return for Final Taxable Period Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period. The one hundred and twenty 120 days period allocated by the authorities was intended to allow sufficient time for businesses to.

Malaysias goods and services tax GST was repealed on 31 August 2018 and a new sales tax and service tax SST applies as from 1 September 2018. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final GST taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018 before 29122018. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

Jul - Aug 2018. The amendment to the final GST-03. Claim input tax that was not claimed before 1 September 2018this is considered the final opportunity to claim input tax.

How To Submit The Gst Final Amendment Anc Group

Ready For Gst Official Newsletter Of Khalid Iqbal Associates Legal Buzz Issues 7

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Introducing Our Latest Enhancements To The Singapore Gst F5 Return Experience Xero Blog

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Submission Of Final Gst Return Estream Software

Malaysia Sst Sales And Service Tax A Complete Guide

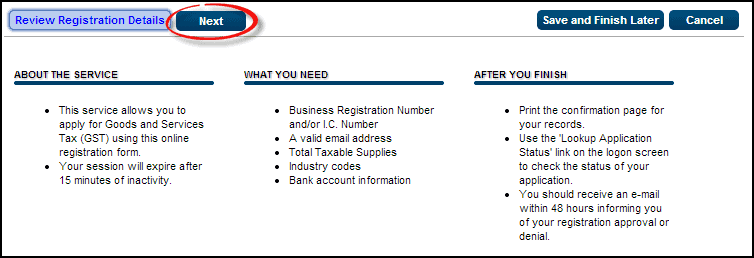

Step By Step Guide To Apply For Gst Registration

Malaysia Amendment To Final Gst Return Kpmg United States

Newsletter 22 2019 Gst Guide On Transition Issue Page 001 Jpg

Introducing Our Latest Enhancements To The Singapore Gst F5 Return Experience Xero Blog

How To File Gst Returns Efficiently

Goods And Services Tax Gst Challenges Faced By Business Operators In Malaysia Topic Of Research Paper In Economics And Business Download Scholarly Article Pdf And Read For Free On Cyberleninka Open

Malaysia Amendment To Final Gst Return Kpmg United States